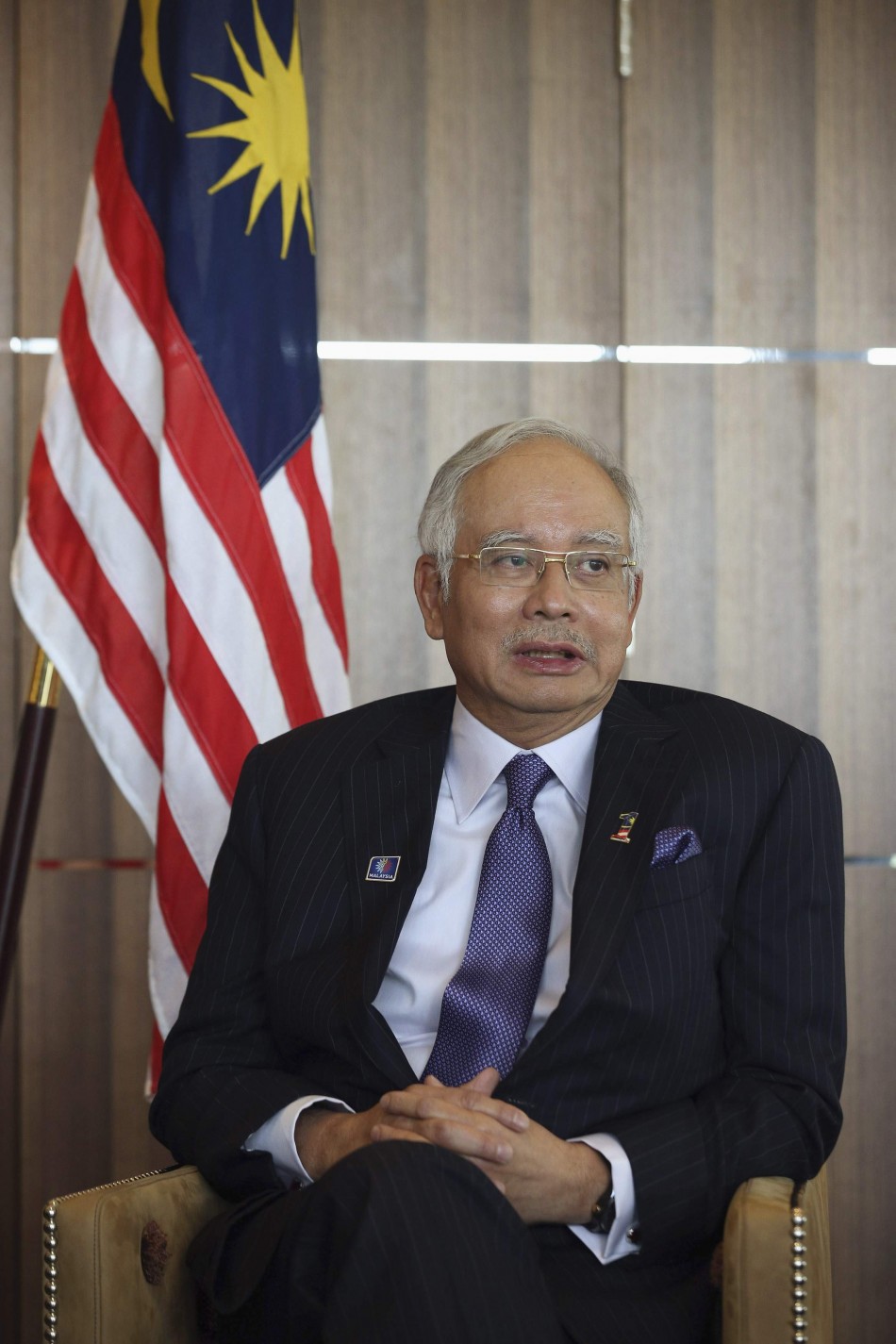

Malaysia's Prime Minister Najib Razak named Asia's worst finance minister 2016

FinanceAsia

has named Malaysia's Prime Minister and Finance Minister Najib Razak as

the worst finance minister in 2016. He pipped 12 other finance

ministers of Asia-Pacific's largest economies for the crown. Last year,

Najib came eighth in FinanceAsia's ranking.

The magazine said that 2015 had been a "very challenging year" for the Malaysian economy, having suffered a "double whammy" of a political scandal involving state fund 1Malaysia Development Fund and Najib. It also faced the collapse in the price of its key oil export.

The scandal over 1MDB triggered demands for Najib to step down, raising doubts in the international arena over Malaysia's commitment to good governance, FinanceAsia added. After months of an internal probe, Malaysian authorities said last month that there was no evidence of any wrongdoing by Najib.

"The long-running political crisis has taken up time that could have been better spent addressing the country's acute economic troubles and made Malaysia appear even less attractive as an investment destination,"

FinanceAsia said. It noted that in the third quarter of 2015, foreign investors pulled out around $5.83bn (£4.04bn, €5.34bn) from the country. The ringgit depreciated by 19% in 2015 - a fall not seen since 1997.

FinanceAsia said: "The main task for Najib will be whether he can manage down the budget deficit of 3.1% of GDP in 2016 from 3.2% in 2015 in the face of a further slowdown in Chinese economic growth and low oil price. Najib's stated aim is to balance the books by 2020, which would be no mean feat for a country that has run a deficit since 1998."

It continued: "How the embattled Najib can improve Malaysia's reputation remains to be seen, but before then he must be ready to figure out a plan to tame the budget deficit while external weaknesses continue to crimp government revenue."

Thailand's Apisak Tantivorawong took the second last 11th spot for the worst finance minister. It noted that Apisak "appears to have limited influence" and that former finance minister Somkid Jatusripitak seems to be leading the government's economic effort with "similar crowd-pleasing tricks".

It said that these moves will drain government funds and are unlikely to leave any lasting economic benefit. "Thailand's economy may grow faster this year but its foundations remain worryingly weak."

The magazine said that the government should focus on getting large-scale infrastructure projects moving, highlighting that Thailand "does not have a positive track record for executing in a timely fashion." - International Business Times, 3/2/2016

For the second year running, FinanceAsia has ranked the finance ministers of the Asia-Pacific region’s 12 largest economies.

For the second year running, FinanceAsia has ranked the finance ministers of the Asia-Pacific region’s 12 largest economies.

FinanceAsia considers several factors when thinking about how to compare the performance of these men over the past 12 months. The role’s responsibilities and powers vary between countries but each minister contributes to fiscal policy and the budget, accesses capital markets, regulates financial institutions, and drives reform. Investor perceptions are one way to view how good a job they are doing, particularly when times are tough.

But the hardest criterion is independence. Most finance ministers serve at the pleasure of their prime ministers, presidents, or military dictators. Their ability to get things done requires political deftness, mastery of policy, sway over the bureaucracy, and the will to fight for the public interest.

Asia developed a post-1997 reputation for quality government, a perception now being put to the test as the Chinese economy slows and dollar strengthens.

For last year's results, click here.

The vast withdrawal of capital from emerging markets makes it all the more imperative for Asia’s finance ministers to pursue good governance, sensible structural reform, and sound finances. Unfortunately, the overall quality of the governments we cover has mostly deteriorated.

Click on the pictures below for the full story.

Source: Finance Asia, 24/2/2016

For the second year running, FinanceAsia has ranked the finance ministers of the Asia-Pacific region’s 12 largest economies.

For the second year running, FinanceAsia has ranked the finance ministers of the Asia-Pacific region’s 12 largest economies.

FinanceAsia considers several factors when thinking about how to compare the performance of these men over the past 12 months. The role’s responsibilities and powers vary between countries but each minister contributes to fiscal policy and the budget, accesses capital markets, regulates financial institutions, and drives reform. Investor perceptions are one way to view how good a job they are doing, particularly when times are tough.

But the hardest criterion is independence. Most finance ministers serve at the pleasure of their prime ministers, presidents, or military dictators. Their ability to get things done requires political deftness, mastery of policy, sway over the bureaucracy, and the will to fight for the public interest.

Asia developed a post-1997 reputation for quality government, a perception now being put to the test as the Chinese economy slows and dollar strengthens.

For last year's results, click here.

The vast withdrawal of capital from emerging markets makes it all the more imperative for Asia’s finance ministers to pursue good governance, sensible structural reform, and sound finances.

Unfortunately, the overall quality of the governments we cover has mostly deteriorated, led by the lowest ranked minister in our study. Take a bow ...

Ranked No12: Najib Razak, Malaysia

Last year was a very challenging year for the Malaysian economy. The country suffered a double whammy of political scandal that enveloped state fund 1Malaysia Development Berhad (1MDB) and Prime Minister Najib Razak, who also happens to be Malaysia’s finance minister. In addition, it endured a collapse in the price of its key export, oil.

The magazine said that 2015 had been a "very challenging year" for the Malaysian economy, having suffered a "double whammy" of a political scandal involving state fund 1Malaysia Development Fund and Najib. It also faced the collapse in the price of its key oil export.

The scandal over 1MDB triggered demands for Najib to step down, raising doubts in the international arena over Malaysia's commitment to good governance, FinanceAsia added. After months of an internal probe, Malaysian authorities said last month that there was no evidence of any wrongdoing by Najib.

"The long-running political crisis has taken up time that could have been better spent addressing the country's acute economic troubles and made Malaysia appear even less attractive as an investment destination,"

FinanceAsia said. It noted that in the third quarter of 2015, foreign investors pulled out around $5.83bn (£4.04bn, €5.34bn) from the country. The ringgit depreciated by 19% in 2015 - a fall not seen since 1997.

FinanceAsia said: "The main task for Najib will be whether he can manage down the budget deficit of 3.1% of GDP in 2016 from 3.2% in 2015 in the face of a further slowdown in Chinese economic growth and low oil price. Najib's stated aim is to balance the books by 2020, which would be no mean feat for a country that has run a deficit since 1998."

It continued: "How the embattled Najib can improve Malaysia's reputation remains to be seen, but before then he must be ready to figure out a plan to tame the budget deficit while external weaknesses continue to crimp government revenue."

Thailand's Apisak Tantivorawong took the second last 11th spot for the worst finance minister. It noted that Apisak "appears to have limited influence" and that former finance minister Somkid Jatusripitak seems to be leading the government's economic effort with "similar crowd-pleasing tricks".

It said that these moves will drain government funds and are unlikely to leave any lasting economic benefit. "Thailand's economy may grow faster this year but its foundations remain worryingly weak."

The magazine said that the government should focus on getting large-scale infrastructure projects moving, highlighting that Thailand "does not have a positive track record for executing in a timely fashion." - International Business Times, 3/2/2016

Finance Minister of the Year: full rankings

By

The Editors

24 February 2016

FinanceAsia considers several factors when thinking about how to compare the performance of these men over the past 12 months. The role’s responsibilities and powers vary between countries but each minister contributes to fiscal policy and the budget, accesses capital markets, regulates financial institutions, and drives reform. Investor perceptions are one way to view how good a job they are doing, particularly when times are tough.

But the hardest criterion is independence. Most finance ministers serve at the pleasure of their prime ministers, presidents, or military dictators. Their ability to get things done requires political deftness, mastery of policy, sway over the bureaucracy, and the will to fight for the public interest.

Asia developed a post-1997 reputation for quality government, a perception now being put to the test as the Chinese economy slows and dollar strengthens.

For last year's results, click here.

The vast withdrawal of capital from emerging markets makes it all the more imperative for Asia’s finance ministers to pursue good governance, sensible structural reform, and sound finances. Unfortunately, the overall quality of the governments we cover has mostly deteriorated.

Click on the pictures below for the full story.

| 1 |

Cesar Purisima

The Philippines

|

|

| 2 |

Arun Jaitley

India

|

|

| 3 |

Choi Kyung-hwan

South Korea

|

|

| 4 |

Bambang Brodjonegoro

Indonesia

|

|

| 5 |

John Tsang Chun-wah

Hong Kong

|

|

| 6 |

Heng Swee Keat

Singapore

|

|

| 7 |

Lou Jiwei

China

|

|

| 8 |

Scott Morrison

Australia

|

|

| 9 |

Chang Sheng-ford

Taiwan

|

|

| 10 |

Taro Aso

Japan

|

|

| 11 |

Apisak Tantivorawong

Thailand

|

|

| 12 |

Najib Razak

Malaysia

|

Source: Finance Asia, 24/2/2016

Najib Razak: Asia's worst finance minister 2016

By

FinanceAsia Editors

2 February 2016

FinanceAsia considers several factors when thinking about how to compare the performance of these men over the past 12 months. The role’s responsibilities and powers vary between countries but each minister contributes to fiscal policy and the budget, accesses capital markets, regulates financial institutions, and drives reform. Investor perceptions are one way to view how good a job they are doing, particularly when times are tough.

But the hardest criterion is independence. Most finance ministers serve at the pleasure of their prime ministers, presidents, or military dictators. Their ability to get things done requires political deftness, mastery of policy, sway over the bureaucracy, and the will to fight for the public interest.

Asia developed a post-1997 reputation for quality government, a perception now being put to the test as the Chinese economy slows and dollar strengthens.

For last year's results, click here.

The vast withdrawal of capital from emerging markets makes it all the more imperative for Asia’s finance ministers to pursue good governance, sensible structural reform, and sound finances.

Unfortunately, the overall quality of the governments we cover has mostly deteriorated, led by the lowest ranked minister in our study. Take a bow ...

Ranked No12: Najib Razak, Malaysia

Last year was a very challenging year for the Malaysian economy. The country suffered a double whammy of political scandal that enveloped state fund 1Malaysia Development Berhad (1MDB) and Prime Minister Najib Razak, who also happens to be Malaysia’s finance minister. In addition, it endured a collapse in the price of its key export, oil.

1MDB first started to attract unwelcome attention in early 2015 after

struggling to settle a RM2 billion ($563 million) bridge loan. The

funding crunch was an embarrassment for Najib, who chairs the fund’s

advisory board and expanded its remit on coming to office in 2009, to

help turn Kuala Lumpur into a financial hub.

Then The Wall Street Journal reported that

nearly $700 million had been transferred to the prime minister’s

personal bank account from the Saudi Arabian royal family, prompting a

series of investigations. The identity of the donor and the reason for

the donation was never disclosed, but it triggered demands for Najib to

step down and cast doubts over about the country’s commitment to good

governance. After seven months, investigators said in January that they

had found no evidence of wrongdoing by Najib.

The long-running political crisis has taken up time that could have

been better spent addressing the country’s acute economic troubles and

made Malaysia appear even less attractive as an investment destination.

According to Moody’s, foreign investors withdrew approximately RM24.5

billion ($5.83 billion) from the country in the third quarter of 2015.

The ringgit also depreciated by 19% last year to its lowest level since

1997.

The main task for Najib will be whether he can manage down the budget

deficit to 3.1% of GDP in 2016 from 3.2% in 2015 in the face of a

further slowdown in Chinese economic growth and low oil prices. Najib's

stated aim is to balance the books by 2020, which would be no mean feat

for a country that has run a deficit since 1998.

In response to falling oil prices and weakening exports, the prime

minister presented a revised 2016 budget plan in January. The original

plan had assumed an average oil price of $48 per barrel, more than 50%

above current levels. The "recalibrated" budget sets a minimum price of

$25.

Rating agency Moody’s, which cut the outlook on Malaysia’s A3 sovereign

rating to stable from positive, has estimated that Malaysia’s fiscal

deficit will likely widen to 3.4% of GDP if the oil price averages $34

per barrel. Other economists think the fiscal deficit has the potential

to blow out to 4% of GDP if things stay the same.

To help lessen its reliance on oil export revenues, the government

introduced a goods and services tax in April in the face of public

opposition. In the short term, though, that’s hurting consumer

confidence, by biting into the spending power of Malaysian households.

The country also joined the US-led Trans-Pacific Partnership trade deal in October to gain greater access to new markets.

How the embattled Najib can improve Malaysia’s reputation remains to be

seen, but before then he must be ready to figure out a plan to tame the

budget deficit while external weaknesses continue to crimp government

revenue. - FinanceAsia, 2/2/2016

No comments:

Post a Comment