For a very long time, Malaysian government DEBT was RM50-RM100 billion. Hence, when PM Anwar Ibrahim disclosed that Malaysia borrowed more - RM96 Billion, it is a BIG DEAL. He said it was lesser compared to annual additional borrowing in 2021 and 2022, which was RM100 Billion per year. All in Malaysian Government DEBT is INCREASING under this government - not reducing.

How much new annual debt in 2010, 2015, 2017, 2018, 2019, 2020? Just to compare with new ANNUAL DEBTS for 2021 and 2022 is rather misleading, as we all know that was the period of the unexpected Covid-19 Pandemic that affected economic activites....but 2023 was after that, and there was a recovery? So, why take an additional LOON of RM96 Billion, increasing Malaysian overall debt even further.

The ordinary man knows about LOANS - how you end up paying so much more for a house, a car, etc - and how you have to continuously pay INTEREST. For the current DEBT, Malaysia spends tens of billions just to service debts.

Are we going to stop increasing Malaysian debt in 2024 - NOPE, we will be still borrowing - this time maybe about RM80 billion plus...so, if PM Anwar remains in power, our Federal DEBT will just keep increasing...putting Malaysia in a precarious position.

No need to 'show off' when you do not have money - be thrifty, and reduce Federal Government Debt...

How much does Malaysian spend every time our Prime Minister goes on his trips to meet foreign leaders, possibly using the Government Jet - not traveling 1st class on MAS flights...?

How much did he spend for MERDEKA celebrations?

Like Najib, that caused our national DEBT to skyrocket, Anwar too fails to behave 'simply' acknowledging our RM1.5 trillion debts - Why pretend to be a PM of a 'very rich' country? Face reality - spend less, REDUCE DEBTS - be responmsible.

Malaysia’s RM1.5 trillion debt time bomb

K. Kathirgugan-12 Aug 2024, 07:00 AM

Malaysia’s growing national debt, if left unchecked, could lead to a debt spiral, decimating the average Malaysian livelihood.

Malaysia is swimming in debt.

Our national debt has been on a consistent upward trajectory over the past few decades. The chart below illustrates the national debt from 1973 to 2023, highlighting a stunning increase in recent years.

Malaysia. (2024, August 8). Economic Indicators, Historic Data & Forecasts | CEIC. https://www.ceicdata.com/en/country/malaysia

Malaysia. (2024, August 8). Economic Indicators, Historic Data & Forecasts | CEIC. https://www.ceicdata.com/en/country/malaysia The chart shows that Malaysia’s national debt has surged from approximately RM31 billion in 1978 to around RM1.5 trillion today, an incredible 48-fold increase in a mere 46 years.

This staggering increase is due to various factors, including extensive government borrowing to fund infrastructure projects, social programmes and economic stimulus packages. The Covid-19 pandemic further exacerbated debt levels, with the government spending considerable amounts of money to prop up the faltering economy.

Growing debt-to-GDP ratio

A critical measure of a country’s debt sustainability is the debt-to-GDP ratio, which compares the national debt to the gross domestic product (GDP). Malaysia’s debt-to-GDP ratio has been rising steadily, raising alarm among economists and policymakers.

As of this year, Malaysia’s debt-to-GDP ratio stood at 65.6%, up from 50% in 2011, as shown in the graph below:

Malaysia. (2024, August 8). Economic Indicators, Historic Data & Forecasts | CEIC. https://www.ceicdata.com/en/country/malaysia

Malaysia. (2024, August 8). Economic Indicators, Historic Data & Forecasts | CEIC. https://www.ceicdata.com/en/country/malaysia This increase indicates that the country’s debt is growing faster than its economy. In comparison, Indonesia and Thailand have much lower debt-to-GDP ratios of 39% and 56%, respectively, highlighting Malaysia’s more precarious fiscal position.

Growing annual debt servicing load

The cost of servicing national debt – the payments required to cover the interest and principal on borrowed funds – is a significant burden on Malaysia’s finances. As the national debt increases, so does the cost of servicing that debt, which diverts resources from other essential areas.

This year, Malaysia’s annual debt servicing load is expected to be around RM46.1 billion, representing around 16% of total government revenue. This figure is expected to rise further as debt levels continue to grow.

In real terms, every extra ringgit we spend servicing our debt is one less ringgit that we could have used for educating our children or shoring up our public services.

Comparison with other government expenses

To contextualise the impact of debt servicing, it is crucial to compare it with other major government expenditure. In 2023, Malaysia’s budget allocated approximately RM52 billion to education, RM17 billion to defence and RM36 billion to healthcare. The annual debt repayment cost, therefore, surpasses the defence and healthcare budgets and constitutes a significant portion of the education budget.

This comparison underscores the substantial financial strain that debt servicing imposes on Malaysia’s fiscal policy, limiting the government’s ability to invest in critical sectors and public services.

Potential consequences of a debt spiral

The potential consequences of Malaysia’s mounting debt are multifaceted and severe. A debt spiral, where increasing debt leads to higher borrowing costs and further debt accumulation, could have several adverse outcomes:

1. Reduced sovereign credit rating: Credit rating agencies may downgrade Malaysia’s sovereign credit rating, making it more expensive for the government to borrow in the future. This could deter foreign investment and undermine investor confidence;

2. Higher interest rates: Rising debt levels can lead to higher interest rates on government bonds, increasing the cost of borrowing and further straining the national budget;

3. Fiscal austerity measures: To manage the debt crisis, the government may be forced to implement austerity measures, including spending cuts and tax increases. These measures can slow economic growth, reduce public services and increase social unrest;

4. Currency depreciation: A debt crisis can lead to a loss of confidence in the national currency, causing it to depreciate. A weaker currency can increase the cost of imports, contribute to inflation and erode the purchasing power of citizens; and

5. Economic recession: In severe cases, a debt crisis can trigger an economic recession, characterised by declining GDP, rising unemployment and reduced consumer spending. A prolonged recession can have lasting negative effects on the country’s economic development and standard of living.

Comparison with debt crises in other countries

Malaysia’s situation is showing some resemblance to the debt crises experienced by countries like Egypt and Sri Lanka. Both nations faced severe economic turmoil due to high levels of national debt, leading to significant economic and social challenges.

Egypt: In the early 2010s, Egypt grappled with a debt crisis characterised by high debt-to-GDP ratios, soaring inflation and declining foreign reserves. The government implemented austerity measures and sought international assistance to stabilise the economy, but the social impact was profound, with increased poverty and unemployment.

Sri Lanka: In recent years, Sri Lanka has faced a severe debt crisis, with debt levels exceeding 90% of GDP. The country struggled with large debt repayments, leading to a currency crisis, inflation and social unrest. Sri Lanka sought assistance from the International Monetary Fund (IMF) to manage its debt and stabilise the economy.

Malaysia’s current debt-to-GDP ratio of 65% is lower than that of Egypt and Sri Lanka during their crises, but the trend is concerning. Without decisive action, Malaysia risks falling into a similar debt spiral.

Conclusion

Malaysia’s growing national debt is a clear and present danger to our country’s stability. The consequences of a debt spiral – as distant and as unlikely as it may seem now – are catastrophic, as Egypt, Greece and Sri Lanka have amply demonstrated. So how do we fix this? - FMT, 12/8/2024

COMMENT | Anwar's misleading statements on debt reduction

COMMENT | When it comes to national debt, discussing it intelligently and accurately is like walking through a minefield - take the wrong steps and you blast wrong information off to a multitude of unsuspecting people, most of whom know little about the subject.

When Prime Minister Anwar Ibrahim said unequivocally that debt has been reduced, as he did in a Bernama report quoting him in an X video, he was undoubtedly wrong.

What has been achieved during his tenure as prime minister is a small reduction in the rate of debt increase.

Instead of increasing by so many billions, it increased by a smaller amount. But the total debt is still increasing albeit at a smaller rate. The situation is better but it is not the same as reducing debt - debt is still inexorably increasing.

What is clear is that the fiscal deficit, the government budget deficit, as a percentage of gross domestic product or GDP (the sum of goods and services produced in the economy), has reduced.

The fiscal deficit is a rough measure among finance people of whether the government may be spending beyond its means. A sustained deficit means the government is spending beyond its means too much, an indication of future problems.

Lower increase

Let’s take debt first. In this case, we are talking about debt the federal government is directly responsible for, the figure which is reported to international bodies such as the International Monetary Fund or IMF.

It excludes contingent liabilities which are things like implicit and explicit guarantees that the federal government has given to others, such as guarantees it made for 1MDB for borrowings and other government corporations such as Petronas, and Khazanah Nasional, among others.

For most reporting purposes national debt is stated excluding contingent liabilities, some of which may however still crystallise in the event of default, such as the 1MDB debt, while others may not, such as Petronas and Khazanah debts.

Anwar mentioned that Malaysia’s debt is between RM1 trillion and RM1.5 trillion. What he probably meant was that the higher figure was if you included contingent liabilities. But unfortunately, that was not made clear.

He was quoted as having said in 2021 and 2022 the nation’s debt reached RM100 billion in each year - that can’t be true. What he must have meant was that the debt increased by RM100 billion a year.

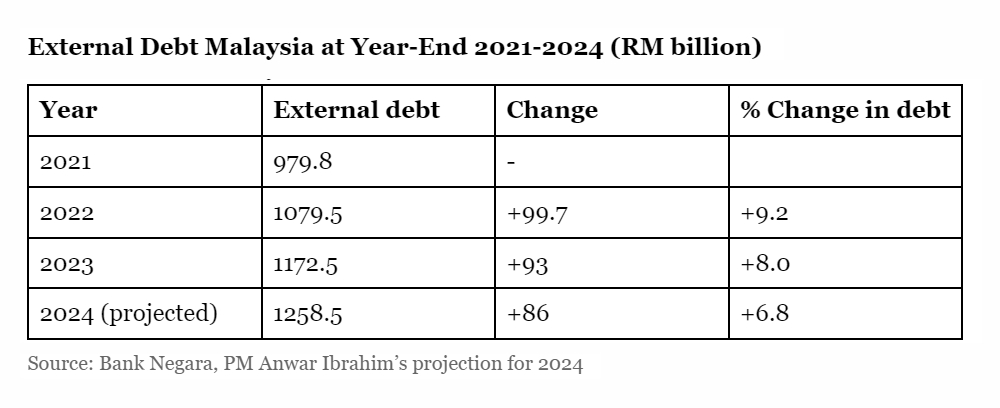

The increase was reduced to RM93 billion in 2023, and it will decline to an increase of RM86 billion this year, according to Anwar.

Rising debt

The point to note is that debt still increased - only the rate of increase decreased. So between 2022 and 2024, over two years, the rate of increase of the debt was reduced from RM100 billion to RM86 billion a year, a reduction of the increase of RM14 billion.

The overall debt is not decreasing but increasing at a reduced rate of RM86 billion a year.

This is clearly borne out by the central bank, Bank Negara Malaysia, in its report for the first quarter of 2024. Anwar came to power in November 2022. The table shows the national debt and its changes from 2021 to 2024. The historical figures match those that Anwar has given.

Of note is the last column which measures the change in the debt level. That is still increasing at a rate of between 6.8 percent and 9.2 percent, which means the debt is still going up, as shown in the first column.

Anwar also stated: “The debt level is high and now stands at 64 percent of GDP. Our target is to reduce it in stages to at least 60 percent.”

He added the national fiscal deficit has been lowered to five percent of GDP in 2023 from 5.6 percent in 2022, and this year it is projected to be reduced to 4.3 percent.

“I present these figures, which are truthful. The Finance Ministry, along with the Statistics Department, release such data from time to time,” he added.

That’s all fine and good. But to take credit for a debt reduction when there was none, and in a situation where debt is increasing, is not acceptable. He should take care to state the situation clearly and without possible misinterpretation.

Leave it to the experts

This task of releasing as well as explaining these figures should be left to the experts who understand them and can interpret them properly for the public without confusion and misinformation.

There are such experts in the Finance Ministry and the Statistics Department. Politicians often have no grasp of these matters.

Also, Anwar was remiss when he did not explain that debt increased rapidly after 2020 because of the onset of Covid-19 and the subsequent serious contraction of the economy - a worldwide impact.

Like the rest of the world, Malaysia had to borrow to spend money to ameliorate the pandemic’s effects and stimulate the economy.

Now that Covid-19 is well behind us, surely Anwar and his Madani government can’t take credit for a slowing in the growth of debt.

In fact, one can ask if the rate of growth of debt could have been checked even more than it was.

P

GUNASEGARAM agrees that too little knowledge is a dangerous thing which

is why all governments rely on experts in specialised areas. - Malaysiakini, 2/8/2024

No comments:

Post a Comment